Feb 10, 2026

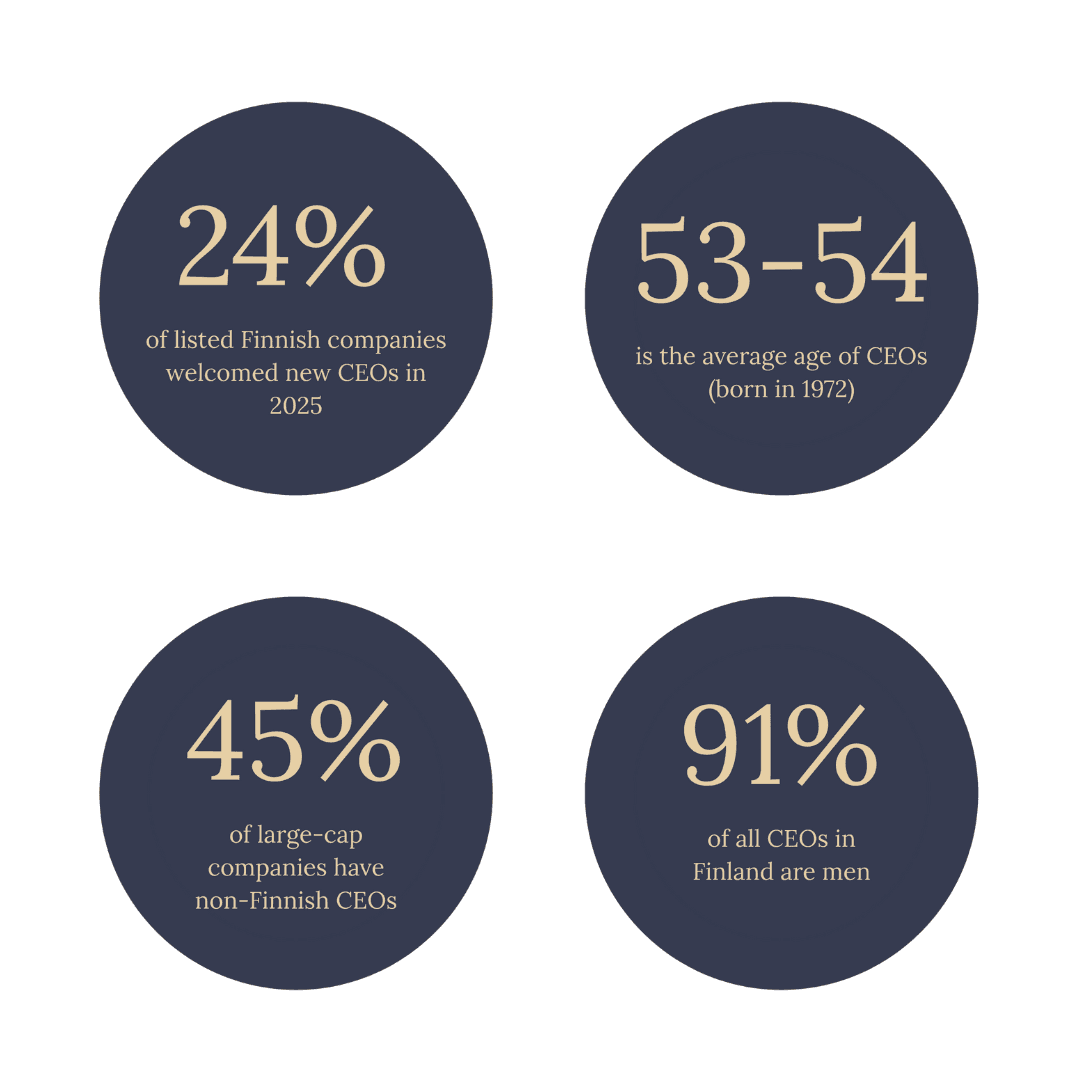

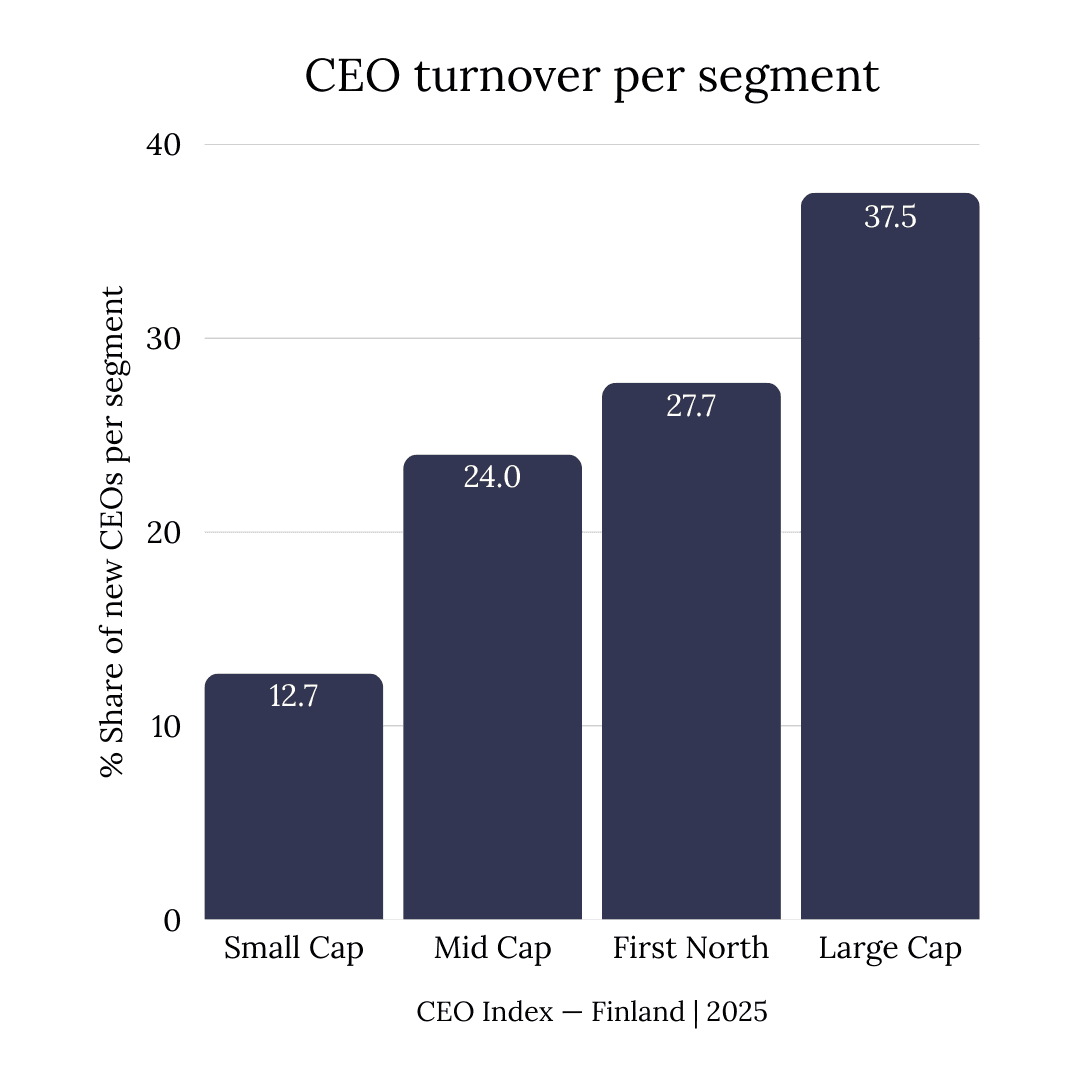

In 2025, 44 out of 184 Finnish listed companies changed their CEO, meaning roughly one in four enterprises appointed a new leader during the year, with the shift most visible among large-cap companies, where foreign CEOs now account for a growing share of appointments, the CEO Index — Finland | 2025 shows.

Among large-cap companies, CEO turnover coincided with a clear move toward more international leadership, according to the latest CEO Index — Finland compiled by Listeds in collaboration with SAM Headhunting.

As of early 2026, 46.9 percent of large-cap CEOs are non-Finnish, bringing Finland’s largest listed companies close to an even split between domestic and foreign leaders. No other segment of the Finnish stock market shows a comparable level of internationalization.

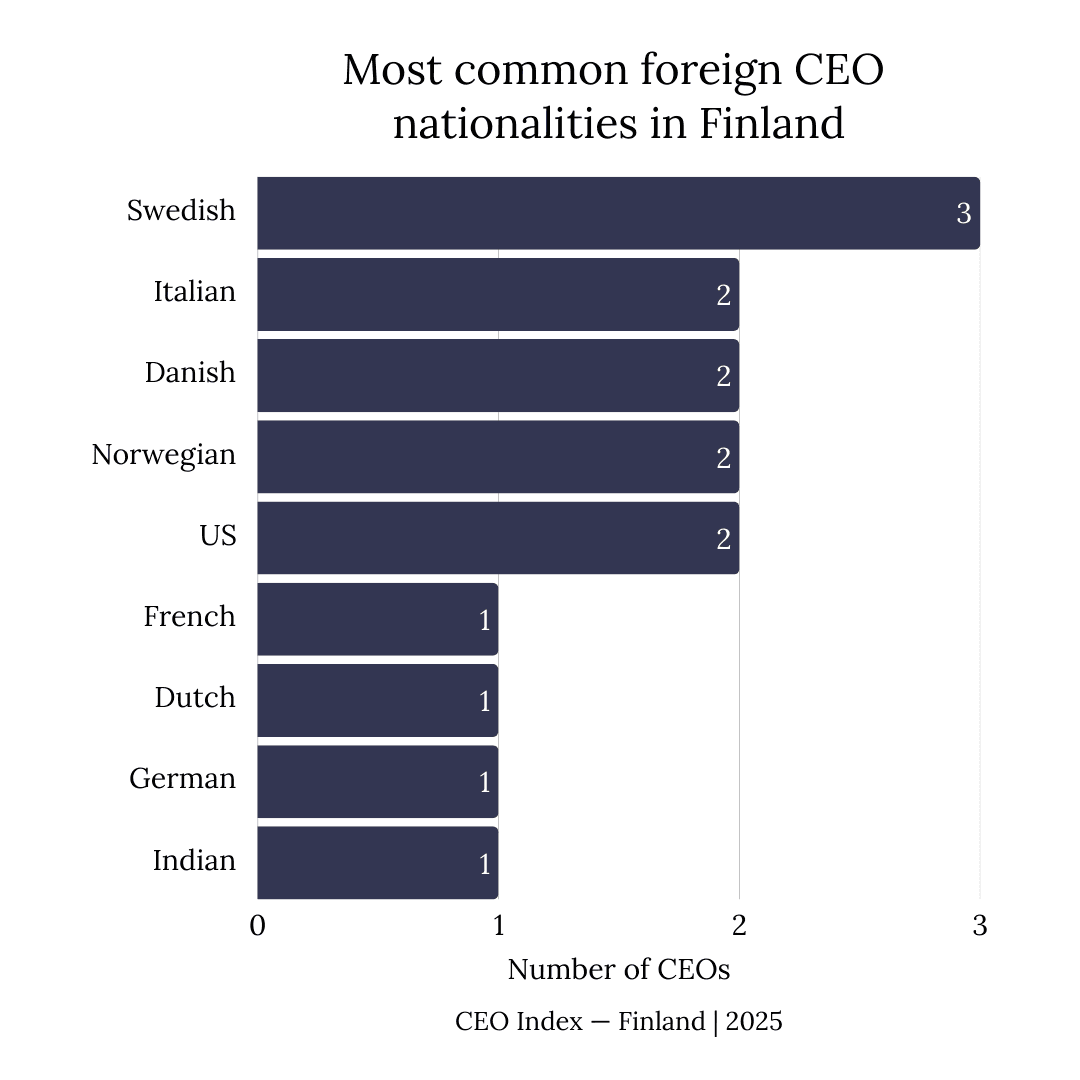

Several of the Helsinki bourse’s biggest companies illustrate the trend. Nokia is led by Justin Hotard from the United States, Telia Company by Patrik Hofbauer from Sweden, and Nordea by Frank Vang-Jensen from Denmark. Among foreign CEOs in large-cap firms, Swedish nationals form the single largest group, followed by leaders from the United States, Denmark, Norway, and Italy.

“International backgrounds are increasingly visible in the leadership of Finnish listed companies, and we expect this trend to continue in the future. It was encouraging to see that in large-cap companies, nearly half of the executives already have an international background,” says Leena Hellfors, managing partner at SAM Headhunting.

Across the broader market, however, leadership remains predominantly domestic. 84.2 percent of all active CEOs in Finland are Finnish, and growth-stage companies listed on First North continue to recruit almost exclusively from the local talent pool. International CEO recruitment is therefore selective rather than systemic, concentrated among companies with the greatest scale and cross-border exposure.

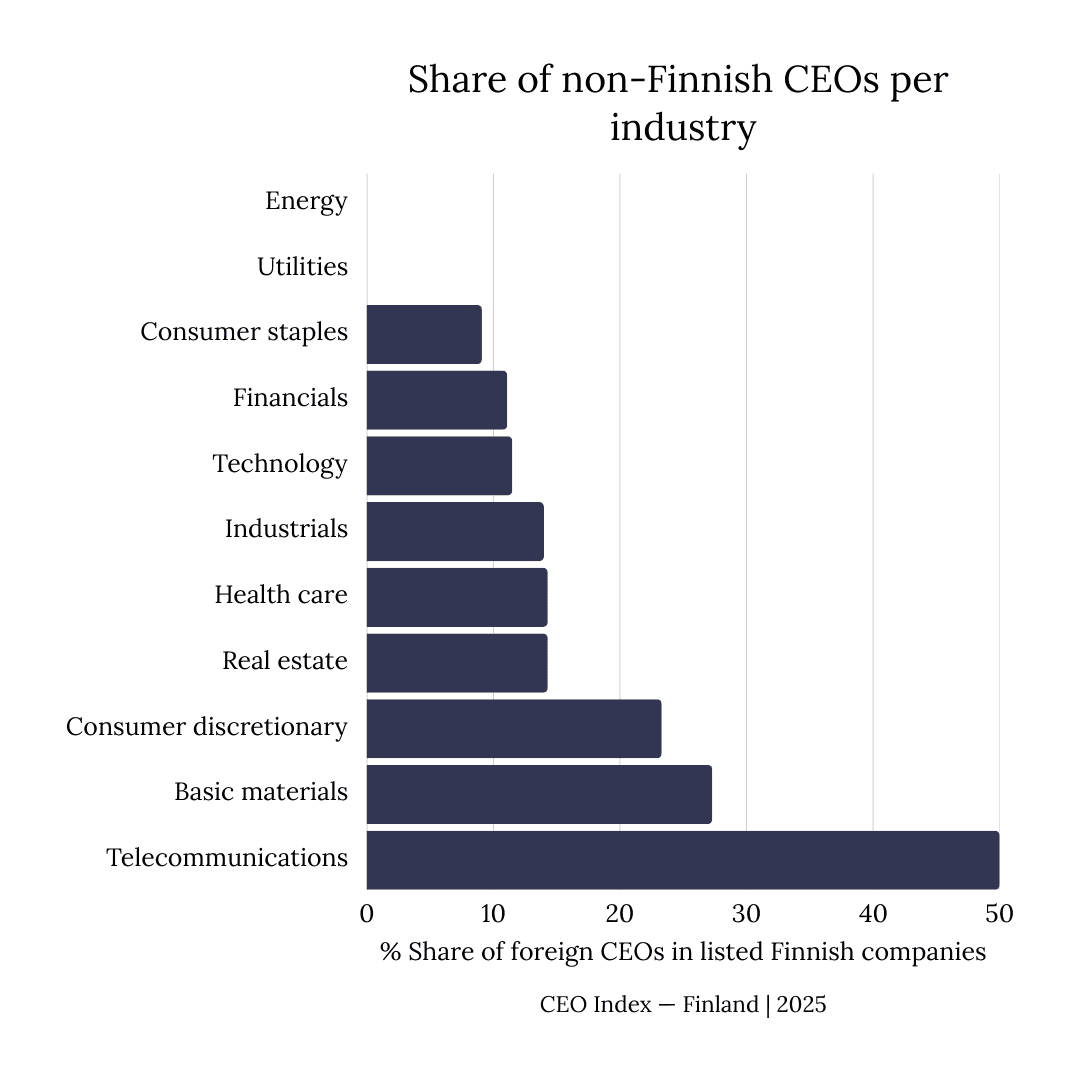

Industry structure shapes where foreign CEOs emerge

The internationalization of leadership is not uniform across sectors. Based on active CEO data as of January 29, 2026, telecommunications and basic materials show the highest shares of non-Finnish CEOs. Industrials, consumer discretionary, technology, and financials also display meaningful international representation.

By contrast, energy and utilities remain entirely Finnish-led, reflecting regulatory intensity, domestic market focus, and more stable operating environments. The pattern suggests that boards are widening their leadership search primarily in industries where global competition and international operations are central to performance.

Turnover was broad, but large caps changed most

Leadership change in 2025 was not limited to any single segment. CEO appointments were recorded across First North, small-cap, mid-cap, and large-cap companies alike.

Measured relative to segment size, however, large-cap companies experienced the highest CEO turnover, with more than one-third of firms changing CEOs during the year. First North companies recorded a similar number of changes in absolute terms, but a lower turnover rate, given their larger population of listed firms.

At the industry level, turnover was concentrated rather than widespread. Industrials accounted for the largest number of new CEO appointments in 2025, followed by consumer discretionary, technology, and financials, while several other sectors saw little or no leadership change.

CEO transitions trigger most management changes in large caps

Following a CEO appointment in 2025, companies recorded an average of 3.7 group management changes, driven by 2.1 new hires and 1.6 resignations.

Change intensity varies sharply by segment. Large-cap CEOs were the most active, averaging nearly double the leadership turnover of other segments, reflecting more deliberate top-team reshaping. First North CEOs showed relatively greater exit-driven change, while mid-cap CEOs favored stability.

The most significant transformation followed the appointment of Scott Phillips at Hiab, who oversaw 19 management changes. Other high-impact CEOs included Endre Rangnes (Tietoevry) and Johan Westermarck (Eezy), highlighting how individual leadership transitions can dramatically reshape executive teams.

Familiarity still matters when boards choose new CEOs

Despite the visibility of international hires, Finnish boards continue to place strong weight on familiarity. Of the 44 new CEOs appointed in 2025, more than half had prior exposure to the company they now lead.

Ten had previously served on the board

Eleven had been part of the management team

Three had experience in both roles

These were rarely rapid successions. Board or management experience often dated back years, reflecting long leadership trajectories rather than short-term promotions.

“High CEO turnover is a critical trend to watch, and its impact is increasingly visible in board recruitment. We are seeing a clear pattern of board members stepping into CEO roles,” says Taru From, senior partner at SAM Headhunting.

A selective shift rather than a wholesale change

Taken together, the 2025 data points to selective internationalization at the top of the Finnish market. Large-cap companies are increasingly open to foreign CEOs, particularly in globally exposed industries, while smaller and growth-stage firms remain firmly Finnish-led.

For boards and investors, the message is clear. Finland’s CEO market is evolving, but it is doing so deliberately, balancing international experience with familiarity and long-term leadership development. For more information, find the CEO Index — Finland | 2025 here.

Source: CEO Index — Finland | 2025, compiled in partnership with SAM Headhunting.