Feb 5, 2026

Produced in partnership with SAM Headhunting

Who leads listed companies in Finland, and how is leadership changing? These are the key questions examined in this report, produced in partnership with SAM Headhunting. The analysis focuses on CEO profiles and appointments in Finnish listed companies in 2025, combining data-driven insight with an executive search perspective.

Leadership patterns continue to reflect differences in company size and sector. Among large-cap companies, Finnish and non-Finnish CEOs are now close to parity, signaling a more international leadership market. In contrast, growth-stage listed companies remain predominantly Finnish-led. At the same time, CEO turnover in 2025 was spread across market segments but concentrated in a handful of industries, notably industrials, technology, and financials.

Highlights:

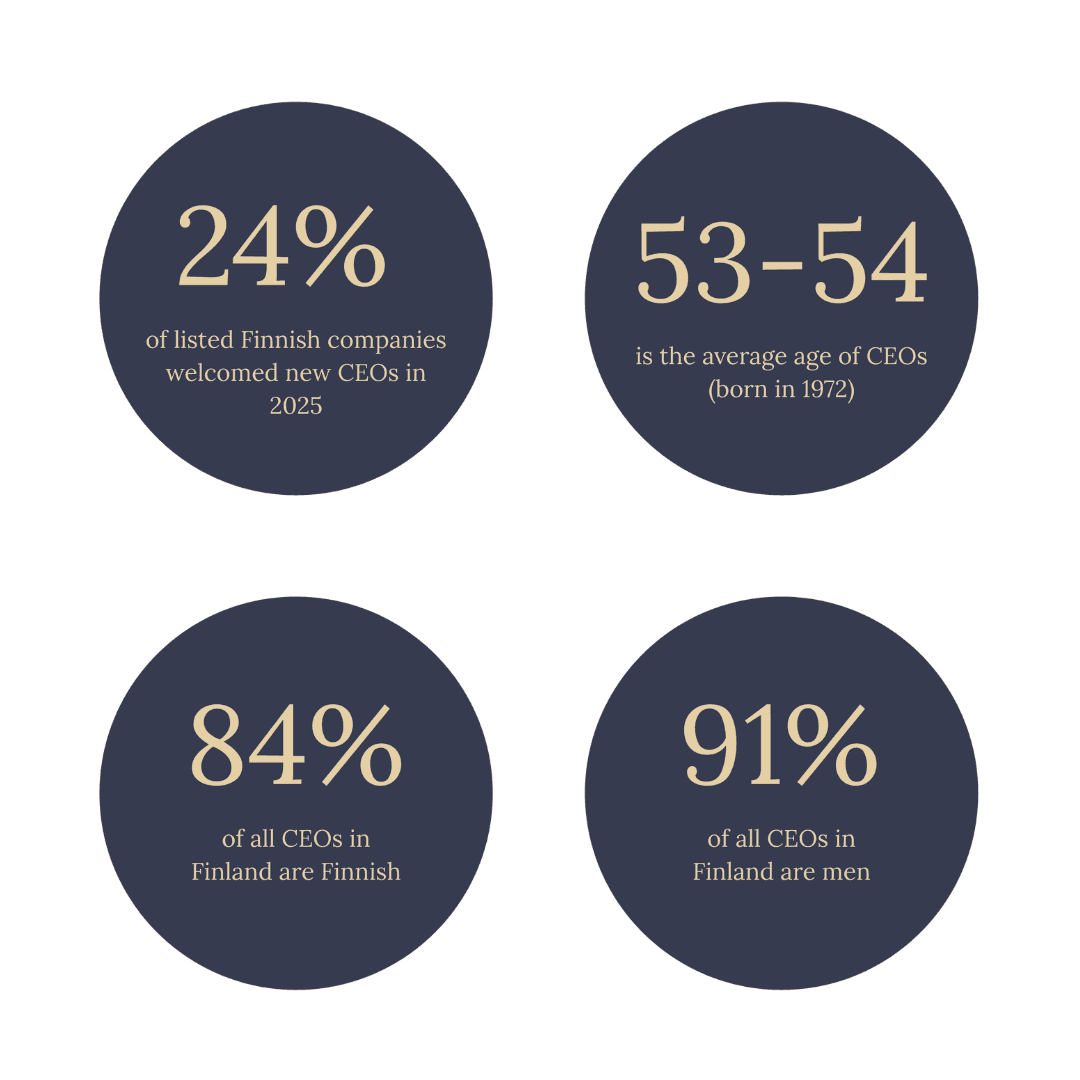

183 active CEOs

44 CEO changes in 2025

90.7% of active CEOs are men

84.2% of active CEOs are Finnish

46.9% of large-cap companies now have non-Finnish CEOs

The findings are based on an updated dataset covering all Finnish listed companies. The analysis includes 183 active CEOs as of 29 January 2026 across 184 listed companies, including Pallas Air, which is run by its CFO, as well as all CEO appointments made during 2025.

A concentrated leadership age profile

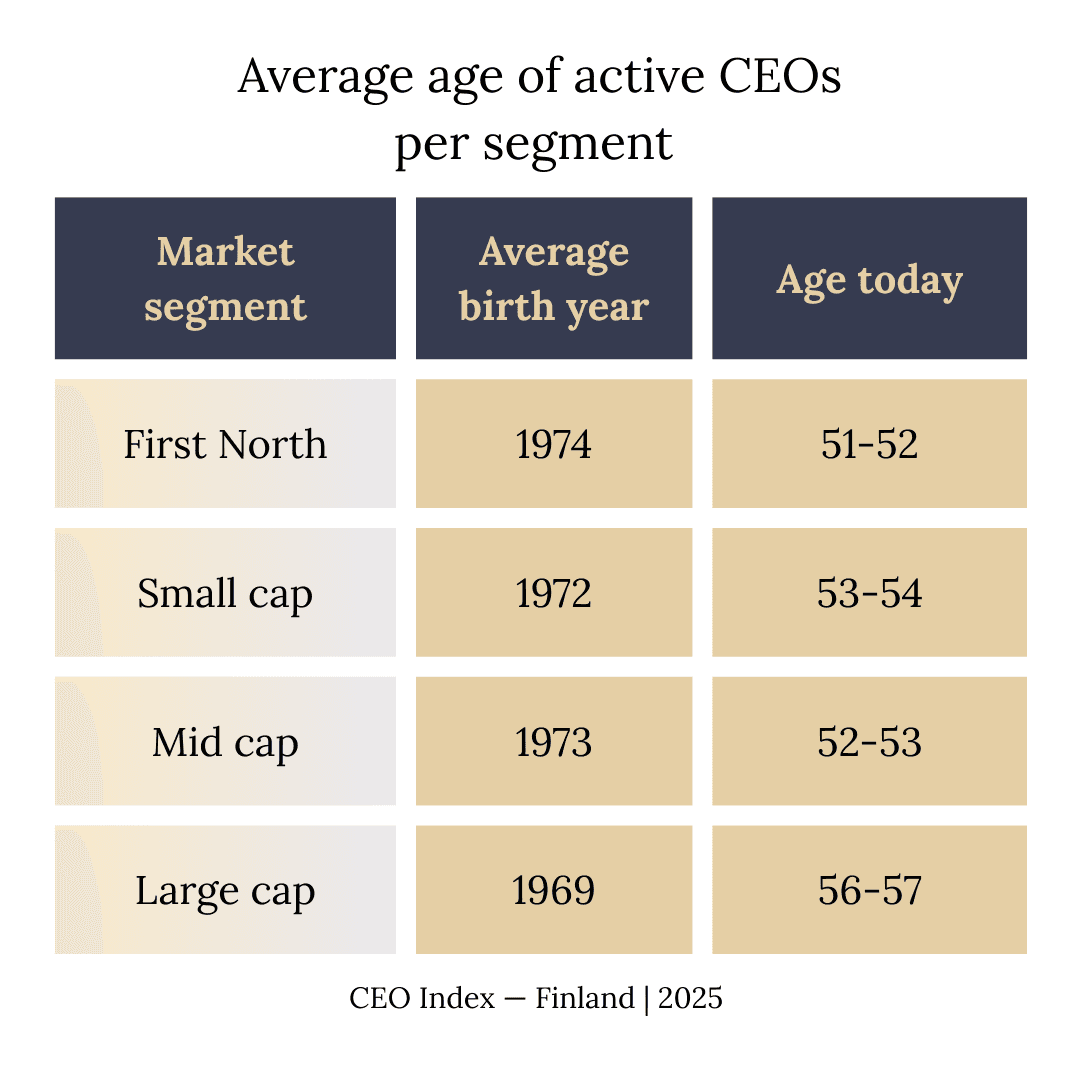

The average birth year of active CEOs is 1972, placing the typical leader of a Finnish listed company in their early to mid-fifties.

Age profiles vary systematically by company size. Large-cap CEOs are the oldest on average, with an average birth year of 1969, while First North CEOs are younger, averaging 1974. With 47 listed companies, First North represents a substantial segment of the Finnish market rather than a marginal outlier. First North is Nasdaq Helsinki’s growth marketplace, designed for smaller and earlier-stage listed companies with lighter regulatory requirements than the main market.

The youngest active CEOs are found in small-cap, mid-cap, and First North companies, with birth years ranging from 1988 to 1990, while the oldest active CEO in the dataset was born in 1958.

Taken together, the data show that large-cap companies tend to have older leaders. The same segments with younger average CEOs, particularly First North companies, also recorded higher CEO turnover during 2025.

Gender representation remains uneven

Gender diversity at the CEO level remains limited across the Finnish stock market. Of the 183 active CEOs, 166 are men, and 17 are women, meaning 90.7 percent of CEOs are male.

Segment-level differences are visible. First North companies show the highest share of female CEOs, at 13.0 percent, while large-cap companies have the lowest, at 6.2 percent. Small-cap and mid-cap companies fall between these two extremes, but no segment exceeds the mid-teens in female CEO representation. Especially in large-cap companies, the percentages reflect very small absolute numbers of female CEOs.

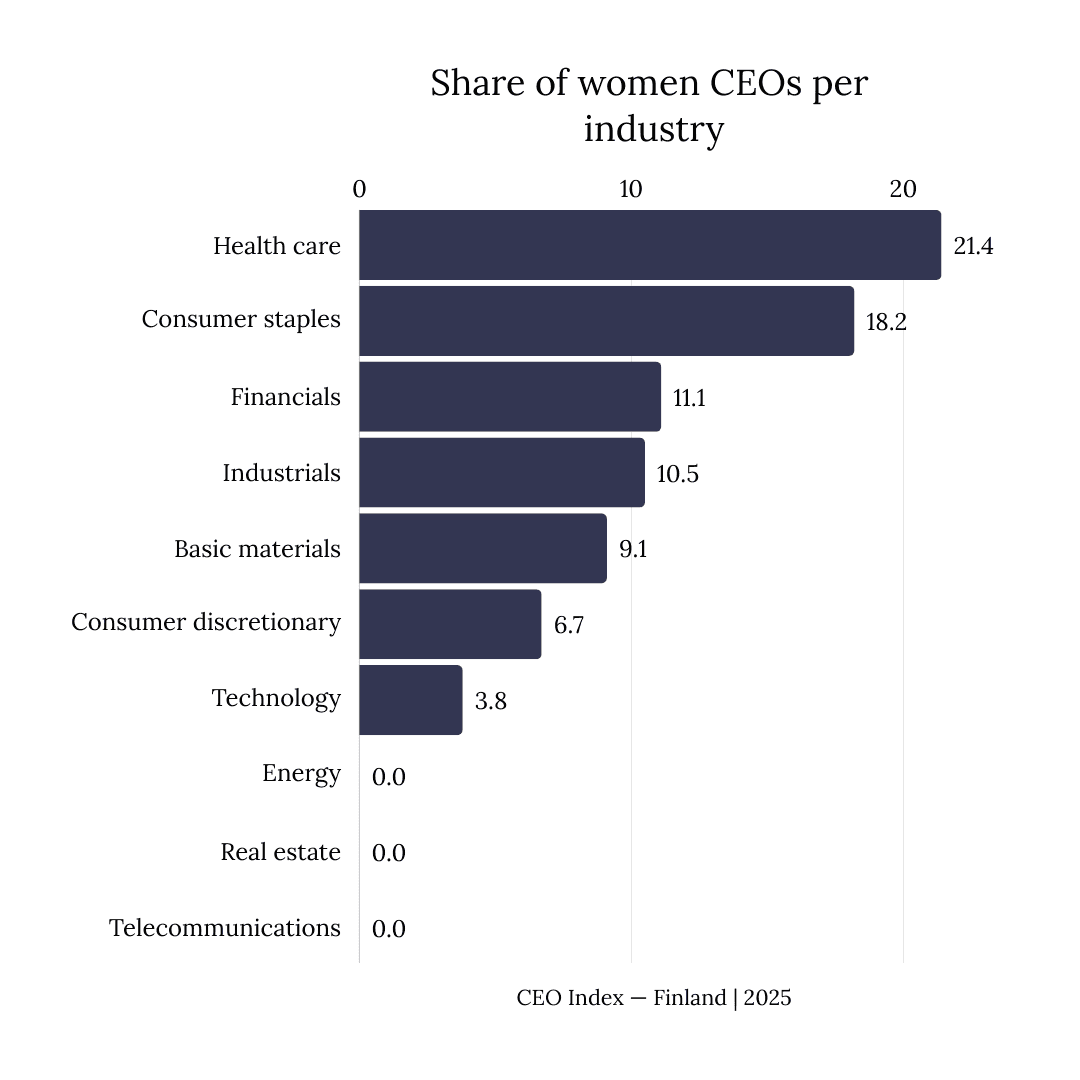

Industry-level data show that female CEO representation varies significantly across sectors. Health care stands out with the highest share of female CEOs at 21.4 percent, followed by consumer staples at 18.2 percent. Financials and industrials sit just above 10 percent, while technology remains below five percent. Several industries, including energy, real estate, telecommunications, and utilities, had no female CEOs among listed companies as of January 29, 2026.

These differences indicate that female CEO representation in Finland is driven more by industry structure than by a uniform market-wide trend. Aggregate figures, therefore, mask sharp contrasts between sectors with established female leadership pipelines and those where representation remains absent.

“While the number of women serving as CEOs of listed companies remains low, we expect this figure to increase steadily. A similar upward trend has already been seen in recent years, particularly in board positions,” says Leena Hellfors, managing partner at SAM Headhunting.

International CEOs remain a large-cap phenomenon

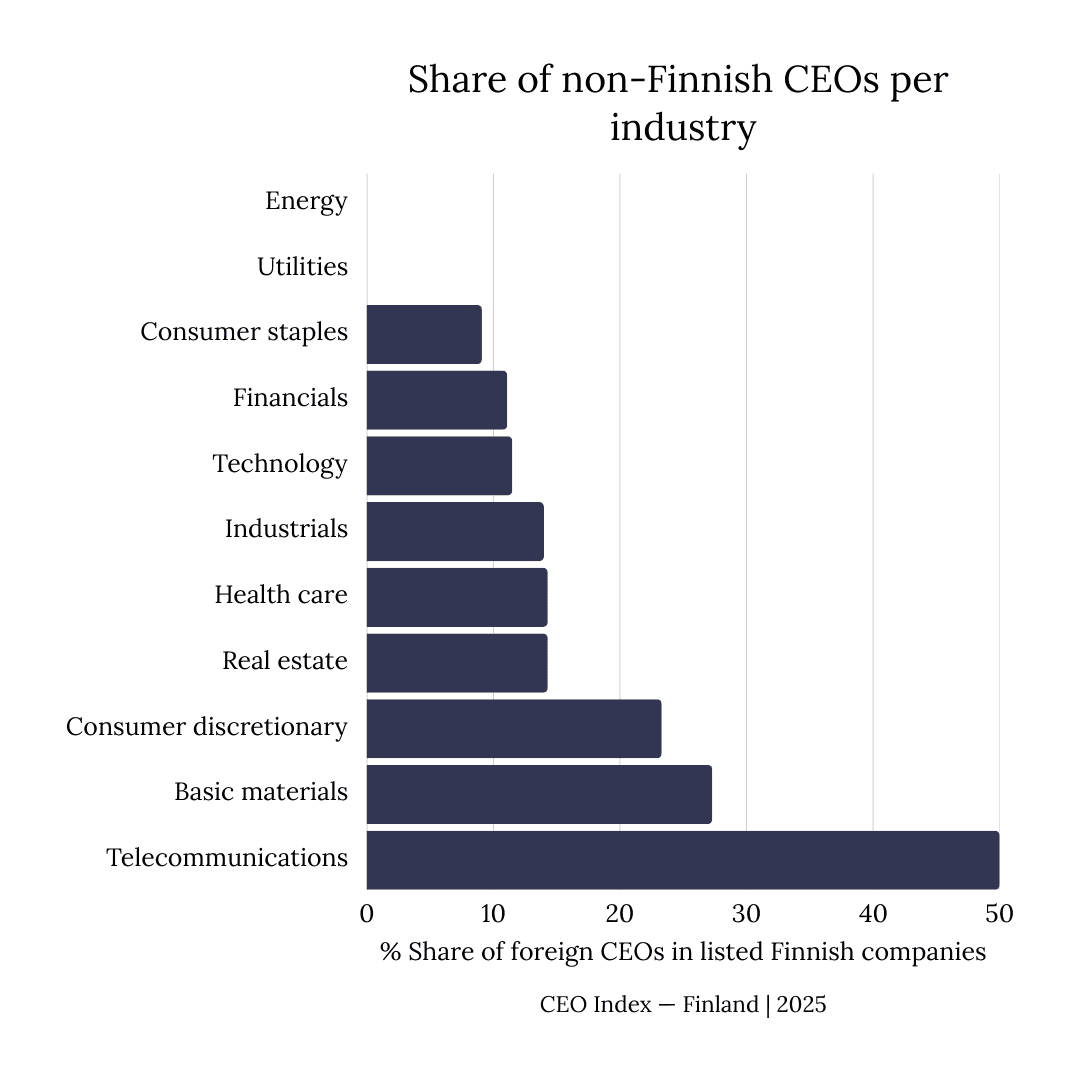

Nationality data show that 84.2 percent of active CEOs are Finnish, while 15.8 percent are non-Finnish. This headline figure hides sharp contrasts by company size.

Among large-cap companies, only 53.1 percent of CEOs are Finnish, meaning 46.9 percent are non-Finnish. With 32 large-cap companies, this group is a major driver of leader immigration. In contrast, 97.8 percent of First North CEOs are Finnish, with similarly high Finnish shares in small-cap (92.7 percent) and mid-cap (82.0 percent) companies.

International CEO recruitment in Finland is therefore primarily a large-cap phenomenon rather than a broad-based market trend. Most non-Finnish CEOs are concentrated in a relatively small group of large-cap firms, while growth-stage and smaller listed companies remain overwhelmingly Finnish-led.

Industry differences reinforce this pattern. Based on active CEO data, telecommunications and basic materials show the highest shares of non-Finnish CEOs, while consumer discretionary, industrials, technology, and financials also have meaningful international representation. In contrast, sectors such as energy and utilities remain entirely Finnish-led. CEO internationalization is therefore shaped not only by company scale but also by structural differences between industries.

“International backgrounds are increasingly visible in the leadership of Finnish listed companies, and we expect this trend to continue in the future. It was encouraging to see that in large-cap companies, nearly half of the executives already have an international background,” says Leena Hellfors.

CEO turnover in 2025 was broad but uneven

During 2025, 44 CEO changes took place among listed Finnish companies. In absolute terms, appointments were distributed across all market segments, with changes recorded in First North, small-cap, mid-cap, and large-cap companies alike.

Measured relative to the number of companies in each segment, large-cap companies experienced the highest level of CEO turnover during 2025, with more than one-third of firms changing CEOs during the year. First North companies recorded a similar number of changes in absolute terms, but a lower turnover rate relative to their 47 listed firms.

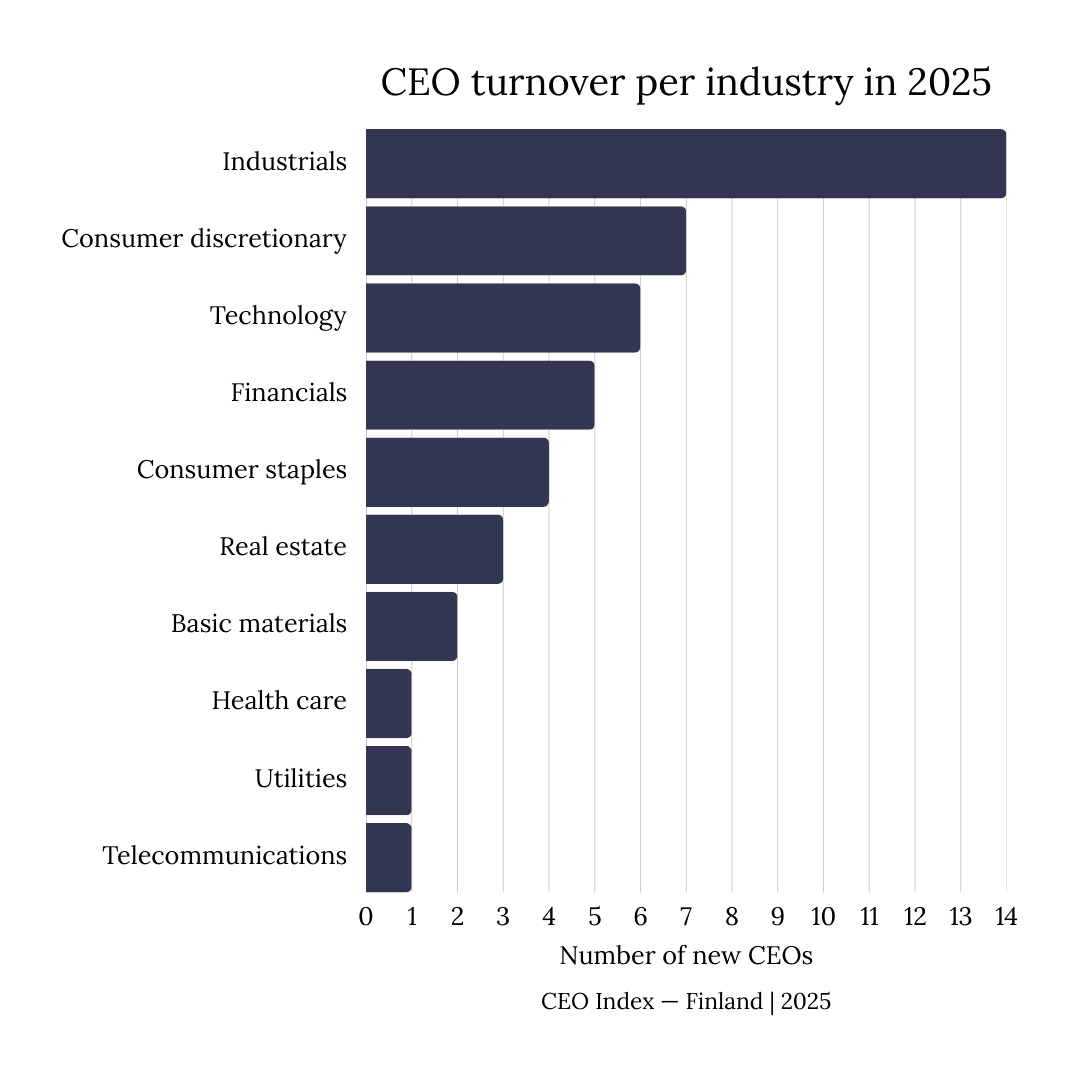

Industry-level data show that CEO changes were not evenly spread across sectors. Industrials accounted for the largest number of new CEO appointments in 2025, followed by consumer discretionary, technology, and financials, while several other industries saw little or no turnover during the year.

Internal experience remains common among new CEOs

The index also sheds light on the backgrounds of newly appointed CEOs. Of the 44 new CEOs appointed during 2025, 20 were recruited externally. At the same time, internal experience remained common.

Ten new CEOs had previously served on the company’s board, and 11 had previously been part of the company's leadership team. In addition, three CEOs had experience both on the board and in management.

These figures describe prior exposure to the company, not direct transitions. Board or management experience may have occurred years before the CEO appointment, reflecting longer leadership trajectories rather than immediate succession moves. In total, 24 of the 44 new CEOs had some form of prior internal exposure to the company before their appointment.

“High CEO turnover is a critical trend to watch, and its impact is increasingly visible in board recruitment. We are seeing a clear pattern of board members stepping into CEO roles,” says Taru From, senior partner at SAM Headhunting.

Outliers highlight the range of profiles

While most CEOs fall within a relatively narrow demographic range, the dataset also includes notable exceptions. The youngest CEO appointed in 2025 was born in 1986 (Pietu Parikka at Wetteri), while the oldest active CEO was born in 1958 (Eshel Pesti, who joined Citycon in September 2025). A small number of appointments involved CEOs with prior board experience, a less common but recurring pattern in certain industries.

A reference point for 2026

This report provides a structured overview of who leads listed Finnish companies and how leadership changed during 2025. By combining segment-level and industry-level perspectives, it offers boards, CEOs, and investors a factual reference point for assessing leadership profiles, turnover, and succession patterns across the Finnish stock market.

Starting in 2026, the index will be updated on a quarterly basis. Readers can subscribe to the dedicated CEO newsletter to receive future updates. Subscribe to the CEO Newsletter here.

Sources of the CEO Index — Finland | 2025: The data are collected from the Listeds Executive Intelligence platform, CEO data, and listed Finnish companies.

Produced in partnership with SAM Headhunting

SAM Headhunting is an executive search company specializing in demanding international direct searches at the European and global level. The company provides executive search, headhunting, board search, and interim management as a service, outplacement, and onboarding solutions for organizations navigating leadership change and growth.